HAKI Safety AB, a Swedish scaffolding and safety solutions firm, has posted positive results for the third quarter of 2024, showing organic growth and improved profitability.

The company’s net sales rose by 1 per cent to SEK 253 million (£18.6 million), with a 13 per cent boost from organic sales. However, divestments and exchange rate fluctuations partially offset this, which negatively impacted overall revenue.

Operating profit for the quarter climbed to SEK 25 million (£1.8 million), an increase from SEK 18 million last year. Adjusted EBITA also more than doubled, reaching SEK 18 million (£1.3 million). Net profit after tax stood at SEK 16 million (£1.2 million), up from SEK 10 million in the same period of 2023.

Sverker Lindberg, President and CEO of HAKI Safety, described the performance as a result of operational efficiencies, despite headwinds from divestments and a volatile market. “Our focus on organic growth has paid off, and we’re encouraged by our improved margins,” he said.

Year-to-date performance subdued

Despite the strong quarterly results, HAKI’s performance from January to September saw net sales fall 17 per cent to SEK 758 million (£55.8 million). The company attributed this to divestments and an 8 per cent organic decline.

However, gross margins improved to 35.7 per cent from 33.5 per cent last year, reflecting efforts to tighten operational controls.

The company’s equity/assets ratio remained solid at 48 per cent, while net debt was reduced to SEK 312 million (£23 million) from SEK 333 million in 2023.

HAKI also confirmed a second dividend payment of SEK 0.45 (£0.03) per share, set for November 2024.

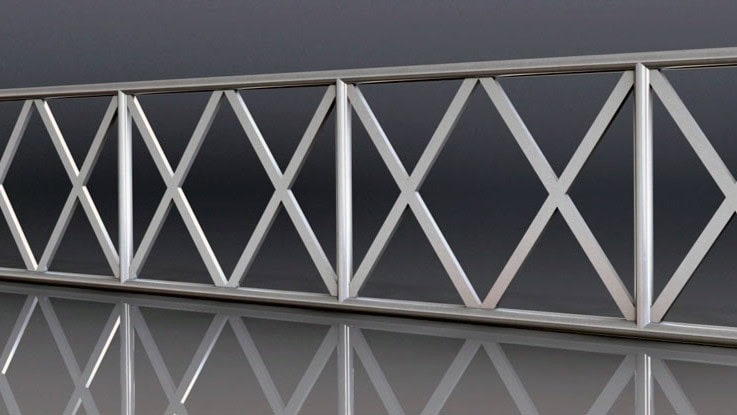

The firm, which specialises in scaffolding systems and workplace safety products, is listed on the Nasdaq Stockholm Small Cap and remains a key player in ensuring safe working environments across industries.