Energy services group Cape saw its shares plunge by more than a third last week after the group issued its third profit warning in a year.

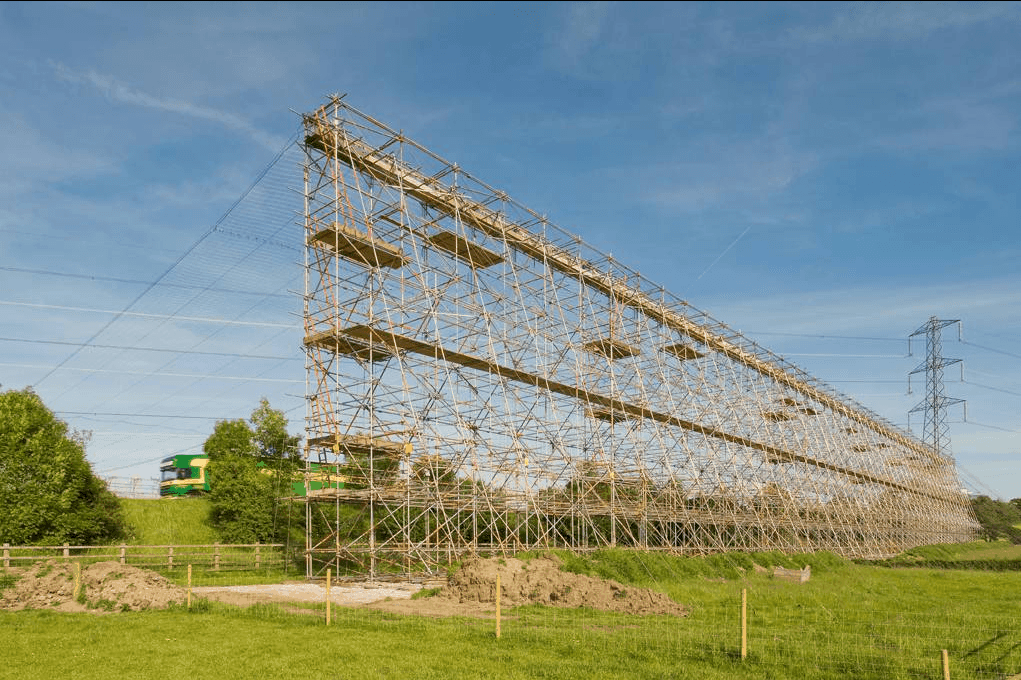

Cape, which provides scaffolding, cleaning and painting services to oil and mining companies, blamed poor trading by its onshore business in Australia.

“The deterioration in performance… will have a significant effect on overall group performance in the near term,” Cape said. Profits in the current year would therefore miss expectations and problems in Asia are “expected to persist into 2013”.

“Lower revenue, combined with increasing pricing pressure, has led to operating margins being significantly lower than previously expected,” the business said. “With delays in major project works in Australia now apparent, no improvement in activity levels is expected in the near term.”

Analysts were concerned that the business failed to win the expected number of contracts.

“Although we felt the share price was pricing in contract slippage, we are disappointed that work packages that we were confident Cape would win have been lost – and this could delay the rate of recovery,” Michael O’Brien, an analyst at Cannacord Genuity, said.

“In addition, we believe that although revenues in the Arabian Gulf are progressing well, margins will be slightly lower than expectations,” Mr O’Brien added. “Given this is Cape’s highest margin area by a long stretch we believe this may concern some investors.”

Cape now expects operating margin, before the impact of any restructuring, to reduce to about half of 2011 levels.

The profit warning was Cape’s third since November. In May, the shares plunged after the group revealed there were problems with a contract in Algeria which would result in a £14m charge. This followed a warning in November in which the company said margin pressure in the Middle East would crimp earnings, as it took a surprise one-off charge for a contract in the North Sea.

Joe Oatley, Cape’s new chief executive, joined the company on June 29 and will now begin a review of the Australian region’s business structure and cut costs.

The shares fell 102.9p to 187p.

News Source: telegraph.co.uk