A campaign calling on the Government to withdraw the implementation of Reverse Charge VAT is gathering pace after it was revealed it could cause a cash-flow crisis across the construction industry.

Over 150,000 businesses within the construction industry are set to see a 20% drop in cash flow when the planned VAT changes come into force on the 1st March. Many have said the impact of this could scupper the construction-led economic COVID recovery.

As previously reported in January the largest industry organisations and trade bodies supported a letter calling on the Government to scrap its VAT changes for construction.

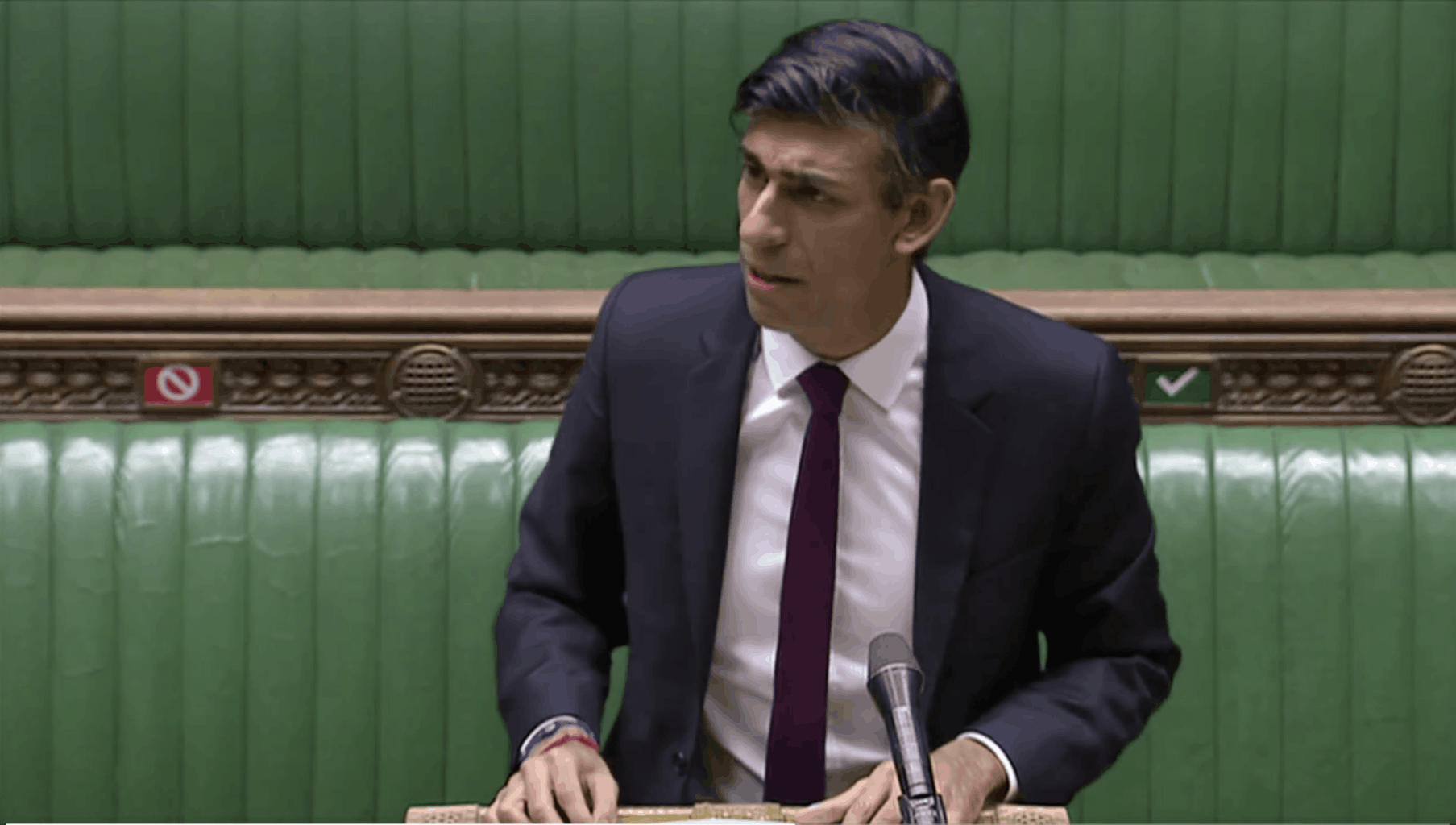

Now the Construction Leadership Council (CLC) which represents the whole construction industry has taken the lead on again urging the Chancellor Rishi Sunak to withdraw the impending changes.

In a letter to the Chancellor, chairman of the CLC, Andy Mitchell wrote: “Despite the Government’s support, our industry remains in extremely challenging times as we continue to adapt to ongoing Covid-19 rules, mitigate the impact of Brexit and prepare for the forthcoming implementation of rule changes on IR35 and the Construction Industry Scheme.

It is also important to note that by continuing to operate the industry has suffered a serious financial impact as a result of project delays and costs incurred in adapting working practices.

This has resulted in many contractual disputes which our monitoring suggests are currently growing and which will accelerate further still.

We are currently quantifying the impact; however, it is reasonable to assume that without further financial support many companies will become insolvent.”

Referring to the Withdrawal of Reverse Charge VAT, Andy Mitchell added: “The implementation of Reverse charge VAT in April will restrict cashflow in our industry, especially to the smallest firms, at an extremely critical financial period for many businesses.

This policy risks reversing any recovery industry has made from Covid-19 and will limit the scope for protecting and creating jobs across the UK. As such, we call for the legislation to be withdrawn to help secure an economic recovery for the long term.”

The CLC hopes the forthcoming Spring Budget on the 3rd March will see Rishi Sunak make an announcement on Reverse Charge VAT and hopefully a change of direction.

See the full letter here: https://www.constructionleadershipcouncil.co.uk/wp-content/uploads/2021/02/Letter-to-Rishi-Sunak-MPChancellor-of-the-Exchequer-from-the-co-Chair-of-the-CLC_26-January-2021.pdf