The UK construction industry has hit the ground running according to information from construction data provider Builders Conference.

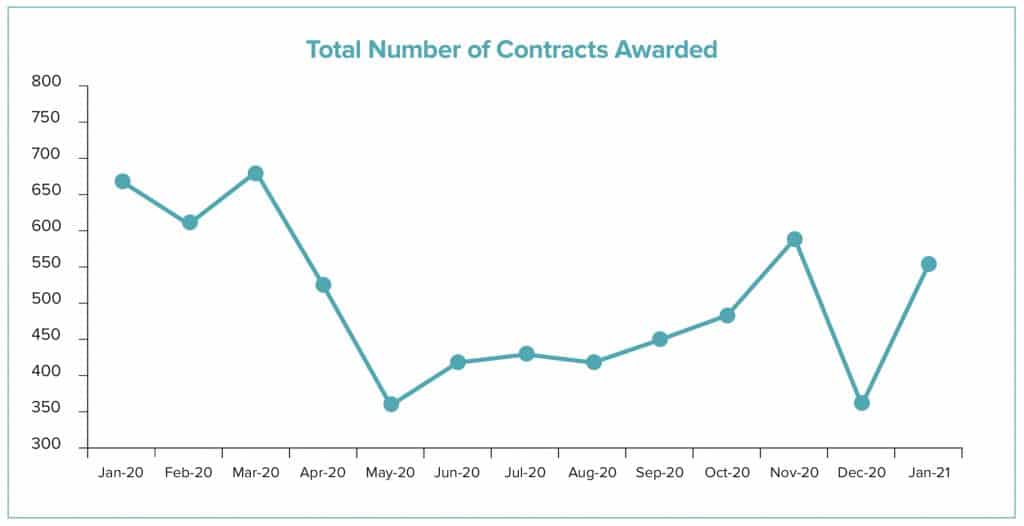

Their latest data shows that the number of construction contracts awarded in January increased, following the traditional slowdown in December.

However, with another national lockdown now in place, the effects of the coronavirus restrictions continue to be felt and both the number and value of contracts remain below pre-pandemic levels, according to Build UK’s State of Trade for Construction.

The number of contracts awarded in January was 551, a 53% increase compared to December (360) and the second highest result since April 2020 when the first lockdown was still in place.

It is still 11% lower than the average number of contracts awarded each month in the year prior to coronavirus (621 between April 2019 and March 2020) and 17% lower than in January 2020 (666), although this was a particularly strong month.

Value of Contracts Holds Up

The value of contracts awarded in January was £6.2 billion. Whilst this is almost 50% down on the previous month, the £12.2 billion worth of contracts recorded in December included two large rail projects worth a combined £8.5 billion. In a positive sign for the industry, the value in January is 3% higher than the monthly average of £6.0 billion between April 2019 and March 2020, although it remains 21% lower than January 2020 (£7.8 billion).

70% of all the contracts awarded by value were in the private sector. Almost half were housing (188 projects worth a total of £2.9 billion), including a £940 million contract to build 2,500 homes on the Teviot Estate in Poplar, East London.

There were also 24 road projects worth £962 million (15%) and 110 education projects with a total value of £823 million (13%).

93% of the contracts were in England, with London leading the way with 31% and the Midlands recording 16%.

Lack of Tender Opportunities

The number of tender opportunities in January was 366, down from 419 in December. This is 52% below the monthly average of 768 projects available for tender between April 2019 and March 2020. It is also 53% lower than January 2020 (786).

At present, there are just 276 tender opportunities available until the end of April 2021, according to Builders’ Conferenc