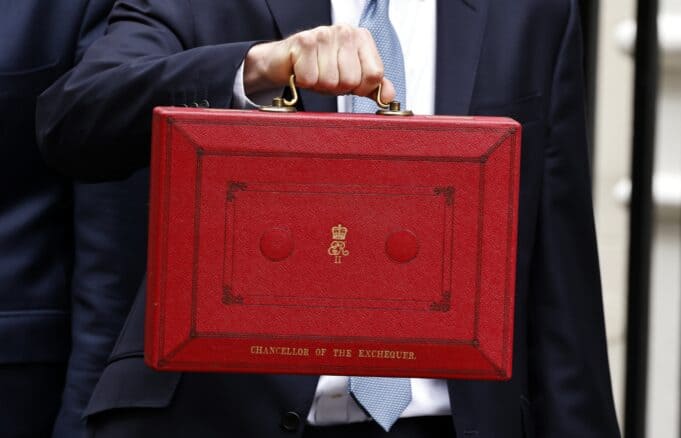

The National Access & Scaffolding Confederation (NASC) has voiced concerns over the latest Budget, questioning the government’s commitment to “get Britain building.”

While the Chancellor’s proposals include significant initiatives aimed at boosting housing and infrastructure, NASC CEO Clive Dickin believes they fall short in providing the necessary support for employment and innovation – areas he sees as essential to economic growth.

Expressing his disappointment, Dickin argued that the Budget sends an unfocused message, with decisions that risk undermining the government’s own goals for economic growth.

“This Budget misses a crucial opportunity to support businesses,” he stated. “Without a clear commitment to fostering business-led growth, this approach could hinder both economic resilience and fiscal health in the long term.”

Rising Costs Challenge Employers

Increased National Living Wage (NLW) rates and employer National Insurance contributions are among the Budget’s measures that Dickin says could place undue strain on employers.

The 6.7% NLW increase, significantly above inflation, is expected to raise salary expectations across sectors, putting pressure on employers looking to expand or maintain their workforce. “Today’s announcement is excessive,” Dickin observed. “It could discourage companies from hiring junior staff and drive inflation even higher.”

The heightened Employers’ National Insurance contributions, including a reduction in thresholds, add to these burdens. Dickin warns this change may make it difficult for employers to recruit or retain staff, further straining the sector at a time when skilled workers are in high demand.

“The increase in NI thresholds could stifle recruitment efforts and dampen the ability to reward existing employees,” he explained. “This isn’t aligned with the government’s stated growth mission.”

Small Businesses Face New Financial Strains

Changes to Business Rates and Capital Gains Tax in the Budget are also expected to impact the scaffolding sector. Removing the “cliff edge” for small firms was a welcome adjustment. Still, alterations to the Small Business Multiplier and Small Business Rates Relief suggest that many small enterprises may face higher costs.

With Capital Gains Tax thresholds also modified, Dickin warns these changes could discourage much-needed investment in the industry, especially in a sector grappling with talent shortages.

NASC’s Call for Business-Focused Reforms

In response to the Budget, NASC has urged the government to consider alternative approaches that better support businesses and promote sustained economic growth.

“The Chancellor’s intention to ‘get Britain building’ must be backed by policies that genuinely empower businesses,” Dickin said. “While there are some benefits for SMEs, such as minor increases to the Employment Allowance, these are overshadowed by the overall cost increases.”

Dickin is calling on the government to work more closely with industry leaders to create a growth strategy that values business as a fundamental driver of the UK’s prosperity.

“Employment and innovation are the cornerstones of a resilient economy,” he noted, stressing that only by fostering these areas can the UK effectively support its construction and scaffolding industries.

As the government rolls out its initiatives to “get Britain building,” NASC’s message is clear: a robust economic recovery hinges on policies that enable businesses to thrive, recruit talent, and invest in future innovation.