Turkish firm URTIM plays key role in record-breaking LNG project

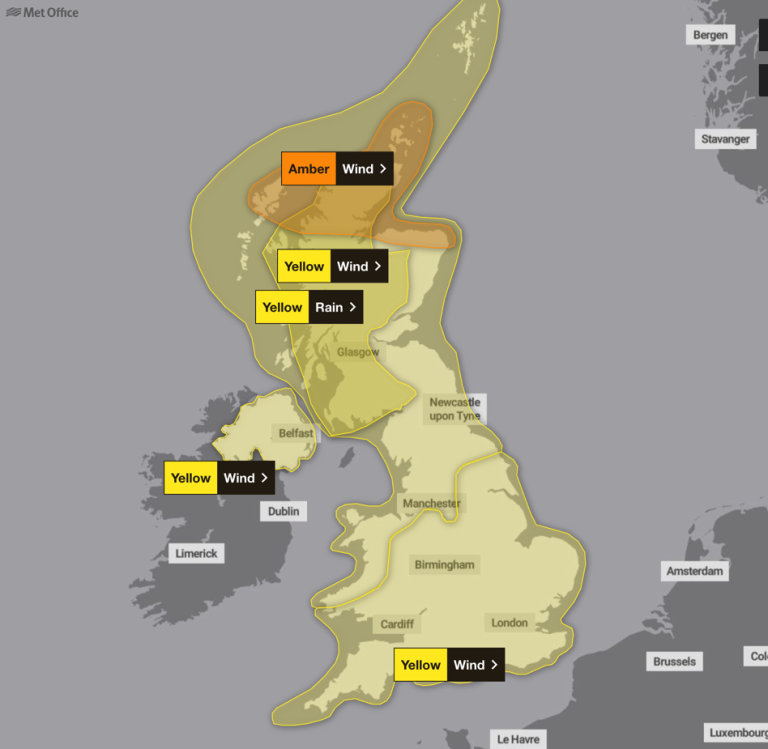

Storm Amy set to hit UK with severe winds and rain

Construction starts slump as housing confidence falters

Ethiopia church scaffolding collapse kills at least 30

Doka tackles extreme Alpine conditions to build Europe’s energy future

Precision engineering at altitude

Doka, which employs 9,000 people worldwide and operates in over 58 countries, has deployed several of its most advanced systems for the Limberg project. The company’s involvement extends from the dam raise itself to the underground cavern housing the new power plant machinery. For the dam construction, Doka has supplied its D22 dam formwork system, which ensures safe load transfer during concrete pours – critical when working on a structure that will eventually reach nearly 129 metres in height. The Top 50 large-area formwork system enables precise shaping of the curved dam blocks, essential for an arch dam where millimetre-level accuracy is required. Safety has been paramount given the extreme working environment. More than 700 running metres of Doka’s folding platform K have been installed to provide reliable and safe working conditions for construction crews operating at height in challenging weather. At the control centre, 22 tonnes of Ringlock modular scaffolding serve as stair towers and flexible working platforms for installation and assembly work.

Safety has been paramount given the extreme working environment. More than 700 running metres of Doka’s folding platform K have been installed to provide reliable and safe working conditions for construction crews operating at height in challenging weather. At the control centre, 22 tonnes of Ringlock modular scaffolding serve as stair towers and flexible working platforms for installation and assembly work.

Transforming construction timelines

Perhaps most significantly, Doka’s approach has dramatically accelerated what would traditionally be a slow and painstaking process. Through advanced 3D planning, pre-assembly of components before they reach the site, and optimised logistics tailored to the high-alpine location, the company has helped reduce concreting cycles to just three days for approximately 260 cubic metres. This represents a considerable achievement. At 1,700 metres above sea level, every aspect of construction becomes more complex. Materials must be transported up winding mountain roads, equipment must function reliably in freezing conditions, and work schedules must adapt to rapidly changing weather patterns. The scale of Doka’s involvement reflects the technical complexity of the project. VERBUND, Austria’s leading electricity company and the project’s client, specifically sought out the firm’s expertise in dam construction for this flagship energy infrastructure project.Supporting Europe’s energy transition

The Wasserfallboden Dam raise will increase the reservoir’s storage capacity by 12.7 million cubic metres, bringing the total to nearly 94 million cubic metres. This expansion will provide approximately 30 gigawatt-hours of additional storage – enough to power around 6,000 homes for a year. Pumped-storage power plants like Limberg III work by pumping water uphill to reservoirs during periods of excess renewable generation, then releasing it through turbines when demand peaks. They are crucial for stabilising electricity grids as countries transition away from fossil fuels.

The Kaprun power plant group, often dubbed the “battery of the Alps”, already includes two pumped-storage facilities dating from the 1950s and 2011. The new Limberg III facility, commissioned on 12 September, operates independently but draws from the same high-alpine reservoirs.

Doka’s work on the project demonstrates how specialist construction technology firms are becoming essential partners in the renewable energy transition. Without the ability to build safely and efficiently in extreme environments, major infrastructure projects like Limberg III would face significant delays or prove economically unviable.

Pumped-storage power plants like Limberg III work by pumping water uphill to reservoirs during periods of excess renewable generation, then releasing it through turbines when demand peaks. They are crucial for stabilising electricity grids as countries transition away from fossil fuels.

The Kaprun power plant group, often dubbed the “battery of the Alps”, already includes two pumped-storage facilities dating from the 1950s and 2011. The new Limberg III facility, commissioned on 12 September, operates independently but draws from the same high-alpine reservoirs.

Doka’s work on the project demonstrates how specialist construction technology firms are becoming essential partners in the renewable energy transition. Without the ability to build safely and efficiently in extreme environments, major infrastructure projects like Limberg III would face significant delays or prove economically unviable.

A showcase for advanced construction

The project, being built by Austrian construction firm Swietelsky AG with overall management by PSKW ARGE Limberg III – a partnership between PORR and Marti Tunnel AG – represents one of Austria’s most significant energy infrastructure investments. For Doka, founded over 150 years ago as part of the Umdasch Group, the Limberg project showcases the company’s evolution from a traditional formwork supplier to a provider of integrated construction solutions. The firm’s involvement spans the entire construction process, from initial 3D planning through to on-site technical support. As European nations work to meet climate targets and reduce dependence on imported fossil fuels, projects like Limberg III are becoming increasingly valuable. The raised dam will be completed in 2027, with Doka’s systems in use throughout 2025 and 2026, helping to secure Austria’s position at the forefront of renewable energy storage technology. The success of the project could provide a template for similar high-altitude renewable energy infrastructure across the Alps and other mountain ranges, where pumped storage offers one of the most effective solutions for balancing intermittent wind and solar generation.Construction leader appointed as new Build UK chair

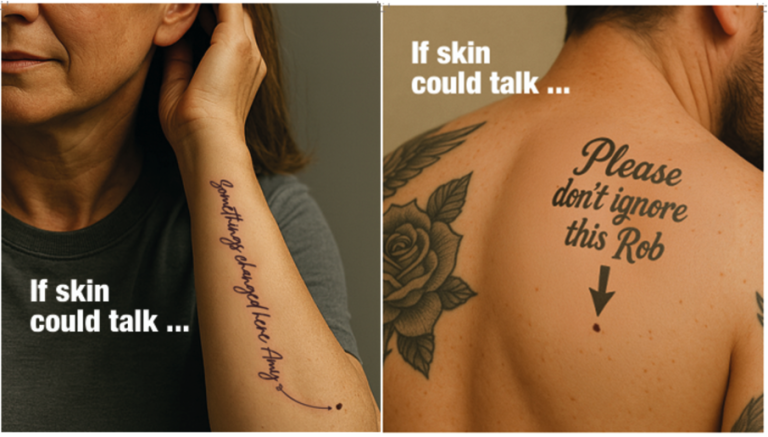

Scaffolders urged to check skin for melanoma signs

‘It turned my world upside down’

Dan Haywood, chief executive of Prime Horizon, said his own melanoma diagnosis had been unexpected. “I never imagined melanoma would happen to me, but it did, and it turned my world upside down,” he said. “Skin cancer doesn’t care who you are or how strong you think you are. “If this campaign helps even one colleague spot melanoma early and get treated, it will be worth it. We all need to know what melanoma is, how to spot it, and take five minutes a month to check our skin. It could save your life.”Fourth most common cancer in men

Melanoma is now the fourth most common cancer among men in the UK, with approximately 22,000 cases diagnosed each year, according to the Melanoma Fund. Michelle Baker, the charity’s chief executive, said early detection was crucial. “Caught early, most cases can be treated successfully,” she said. “This campaign reaches those most at risk in a direct and practical way, making it impossible to ignore the signs. “If skin could talk, it would be telling us to pay attention, and our campaign gives people the tools to listen. Education, early detection and action save lives.” The campaign materials are available free of charge throughout October and November at melanoma-fund.co.uk/ifskincouldtalk.ScaffChamp 2026 dates confirmed as registration prepares to open

Global reach

In a bid to expand the competition’s international appeal, organisers have reserved three places specifically for teams from Asia, Africa, and Australia or New Zealand. The reserved spots will remain available until January 2026, with organisers acknowledging the logistical challenges of bringing teams from these regions to Lithuania. “Chile has already shown that nothing is impossible,” organisers said, referencing the South American nation’s participation in previous editions. If no teams from the designated regions apply by the January deadline, the three reserved places will be opened to all competitors without regional restrictions.Supporting the next generation

As recently reported, one place has been dedicated to a joint team of Scottish and Northern Irish apprentices, forming part of an initiative to encourage young people into the scaffolding profession. The scheme aims to promote interest and motivation among the next generation of scaffolders, providing apprentices with the opportunity to compete on an international stage.Registration details

In a departure from previous years, registration is set to open tomorrow (1 October) through an application form on the ScaffChamp website, making 15 spots immediately available to teams worldwide. The decision to open registration four months earlier than usual – normally held in January – reflects the organisers’ ambition to attract a more diverse international field and allow teams adequate time to prepare. Since its launch in 2019, the championship has become a premier event in the scaffolding industry, showcasing technical skill, safety practices and teamwork among international competitors. Further details about the competition format and requirements are expected to be released when registration opens.AK Scaffolding to represent UK at Las Vegas scaffold competition

AK Scaffolding will represent the UK at the 2026 Scaffold Builders’ Competition, taking place at the World of Concrete Expo in Las Vegas.

The event, organised by the Scaffold & Access Industry Association (SAIA) and sponsored by Layher, is recognised as one of the scaffolding industry’s leading contests. It challenges teams to build and dismantle complex scaffold structures within strict time limits, while being judged on safety, accuracy, and teamwork.

AK Scaffolding, led by Aaron King, earned international attention after competing at ScaffChamp in Lithuania earlier this year. The company will now step onto one of the industry’s biggest global stages in the United States.

Mr King said: “We’re delighted to be heading to Las Vegas to compete on such a huge platform. We’re proud to be a force for good — all the work we do with prisoners and ex-offenders, paying for their training courses and giving them that second chance, sets us apart. We’re the only scaffolding specialised labour-only company doing this, and we want to show what’s possible when you invest in people.”

Paige DeVosha, Operations Administrator at the SAIA, added: “The SBC brings together some of the world’s best scaffold builders to showcase their skill, safety, and innovation. We wish AK Scaffolding the very best as they represent the UK.”

The 2025 edition of the competition saw Scaffold Resource, Inc. of the US take the top prize, with Leading Edge Scaffold finishing second and Bechtel Equipment Operations in third. That event featured 18 teams, including international entries from the UK.

The World of Concrete Expo attracts tens of thousands of visitors each year and is among the largest construction trade shows in the world. Alongside the competition, the 2026 event will also feature training sessions, equipment demonstrations and industry awards.

Scaffolders voted UK’s toughest trade

- Tradespeople’s top three: Scaffolders, Roofers, Stonemasons

- Public’s top three: Roofers, Stonemasons, Scaffolders