The Scaffolding Association has appointed seasoned industry leader Mark Parkin as its new Strategic Director, in a move set to bolster the organisation’s ongoing efforts to improve safety standards, elevate industry recognition, and support its growing membership base.

With a career spanning 37 years, Mark Parkin brings a wealth of frontline experience to the role. His journey through the scaffolding sector has included positions as an advanced scaffolder, supervisor, managing director, CEO, and operations director. This extensive background gives him a unique perspective on the sector’s challenges and opportunities—from the ground up.

Mr Parkin is expected to play a central role in shaping the Association’s strategy and furthering its mission to promote scaffolding as a highly skilled and essential industry.

Robert Candy, CEO of the Scaffolding Association, welcomed the appointment, describing it as a “perfect fit” for the organisation’s goals.

“Mark’s extensive industry knowledge, hands-on experience, and strategic mindset align perfectly with the Association’s mission,” said Mr Candy. “His expertise will help the Association continue its work in supporting members, driving innovation, and ensuring the scaffolding industry gains the recognition it deserves.”

Mr Parkin, who has long championed professional development and operational excellence within the sector, said he was eager to take on the new challenge.

“I’ve spent 37 years in the scaffolding industry—not just working within it but striving to understand it at its core: its challenges, its opportunities, and the people who make it what it is,” he said.

He added that one of his key ambitions is to help businesses reframe their thinking to overcome common hurdles.

“All too often, I see businesses struggling because they can’t see the options available to them,” Parkin said. “Using the right approach for each challenge requires an open mind and the ability to think outside the box. Sometimes, you just need to reframe what’s in front of you to get a different perspective.”

In his new role, Parkin will work closely with the Association’s leadership team to strengthen member support, champion best practice, and cultivate closer collaboration across the sector. His focus will also include helping to future-proof the industry by encouraging innovation and a more unified voice for scaffolding professionals.

The Scaffolding Association has grown steadily in recent years, becoming one of the UK’s leading trade bodies for the access and scaffolding industry. With Mr Parkin now in post, the organisation hopes to accelerate its progress in building a stronger, more resilient future for the sector.

Joe has also recently given on-site training at Hinckley Point. “A lot of our practical training is done at whichever of our four depots is closest to the customer,” he says. “But we also do a lot of training on site, where that’s more appropriate. We cover the whole country to support our customers in the best way.”

“On-site training is a great way to reinforce any original training courses,” says Joe. “While initial training is fresh in the mind for a couple of days, it could be several weeks until scaffolders are actually on a job, and then some of the elements of the training might have faded from their memory. So working with them on site allows them to refresh that training and see exactly how it all works in practice.”

Joe has also recently given on-site training at Hinckley Point. “A lot of our practical training is done at whichever of our four depots is closest to the customer,” he says. “But we also do a lot of training on site, where that’s more appropriate. We cover the whole country to support our customers in the best way.”

“On-site training is a great way to reinforce any original training courses,” says Joe. “While initial training is fresh in the mind for a couple of days, it could be several weeks until scaffolders are actually on a job, and then some of the elements of the training might have faded from their memory. So working with them on site allows them to refresh that training and see exactly how it all works in practice.”

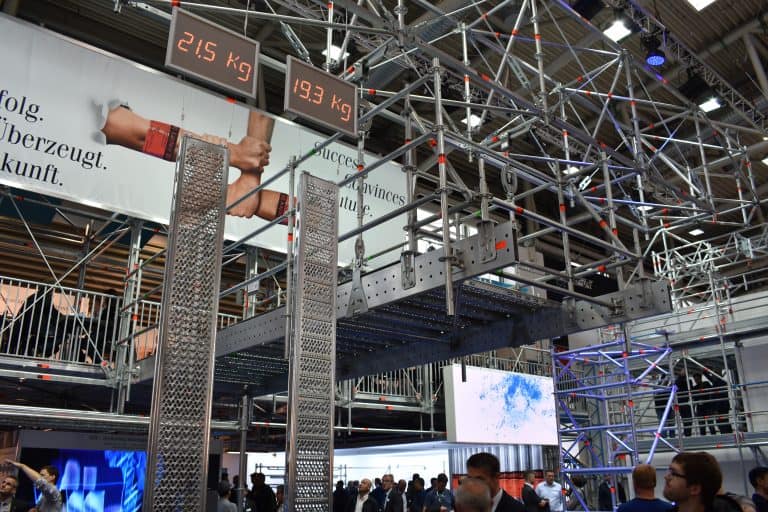

“From my point of view, with more than 50 years’ experience in the industry, I know that this approach makes a big difference to scaffolding contractors,” says Moore. “It’s easy to sell something and leave the customer to get on with it, but the success of a business like Layher is inextricably linked to the success of its customers – so why wouldn’t you invest in helping them to get the very most from your products?”

Des has already run several of these courses for Layher’s existing customers, and delivered information to prospects so that they can make informed commercial decisions about choosing to use system scaffolding in the first place, and then selecting which supplier to use.

“What I like about working with Layher, is that there’s so much product expertise in the business,” says Moore. “From the sales team to the after-sales support, there’s a real focus on practical experience – I have it myself, having used Layher Allround for a long time during my career. Having access to all that expertise and experience is a real positive for customers, because they know we have the ability and desire to support them at every point in their Layher journey.”

“From my point of view, with more than 50 years’ experience in the industry, I know that this approach makes a big difference to scaffolding contractors,” says Moore. “It’s easy to sell something and leave the customer to get on with it, but the success of a business like Layher is inextricably linked to the success of its customers – so why wouldn’t you invest in helping them to get the very most from your products?”

Des has already run several of these courses for Layher’s existing customers, and delivered information to prospects so that they can make informed commercial decisions about choosing to use system scaffolding in the first place, and then selecting which supplier to use.

“What I like about working with Layher, is that there’s so much product expertise in the business,” says Moore. “From the sales team to the after-sales support, there’s a real focus on practical experience – I have it myself, having used Layher Allround for a long time during my career. Having access to all that expertise and experience is a real positive for customers, because they know we have the ability and desire to support them at every point in their Layher journey.”