The NASC announces the launch of its 2015 Safety Report

The NASC has today launched its 2015 Safety Report – documenting accident statistics for all NASC full contracting member companies in 2014, covering 14,988 operatives, which constitutes a major proportion of the UK’s total scaffolding workforce.

All 200+ NASC full contracting members are required to submit a completed annual accident return as a requirement of their membership, and the NASC Safety Report is based on data generated by this exercise. It features:- Injuries and fatalities to operatives, members of the public and third parties.

- Accident causes and types.

- Detailed analysis of accidents.

- Comparison of HSE/NASC accident statistics.

- What the NASC does to support safe scaffolding practice.

From Scaffolder To Scaffold Design – My Story

An ex-scaffolder explains how he made the transition from being a well paid scaffolder to become a Technical Design Draughtsman at one of the UK’s leading scaffold design firms.

So you have put in the hours day in day out of hard graft, successfully working your way up the industry ladder and finally making it into the fold by becoming an highly experienced fully compliant scaffolder… but have you ever contemplated on what you should do next in your career..? How about Scaffold Design ? Ex-scaffolder Alex Kirk of 48.3 Scaffold Design shares his inspiring story, in his own words Alex reveals how one day he laid down his spanners for the final time to begin his journey to become a Technical Design Draughtsman at one of the UK’s leading scaffold design firms. Alex’s story emphasises on a huge personal sacrifice he and his family have made, his hard work, dedication and drive resonates throughout the piece.Alex Kirk’s Journey

Over the course of my time within the scaffolding industry by far and away the most popular question amongst scaffolders who have achieved a decent level of competency is: “how much did you take home last week?” the second most common question is “How do you become a Scaffold Designer?” although the answer to the first question is relatively simple (enough to come back this week!) the second is not as clear cut and simple. My own path to becoming a Technical Design Draughtsman is by no means the only route available but it is the route that I have taken. You could say I was lucky in that I am a third generation scaffolder; whose family owns their own scaffold firm. So really I have been privileged to be in and around scaffolding since before I could walk. I often joked that my dad gave me a spanner as a baby instead of a rattle, in fact that’s an exaggeration but not as big as you might expect. I think the most important trait anybody who wants to make the transition needs above all is ‘Drive’. This is not an easy path to follow. For example in 2009 I was a charge hand scaffolder earning relatively good money on some large construction projects with my girlfriend (now wife) pregnant with our first child. It was at this point I decided I needed to get the ball rolling in pursuing my long term career ambitions, I knew I didn’t want to stay scaffolding forever but I wanted to be able to use the experience and knowledge I had gained over the years. As soon as I started to look at other professions within the industry it became abundantly clear I was going to need to further my education.My educational path

Having not been in formal education for some time, this was a scary realisation. Initially I studied for a NEBOSH General Certificate through work. In my opinion this was a fantastic course that not only provided me with a broader knowledge of the construction industry but also prepared me mentally for learning. After the completion of the NEBOSH course I looked around at institutions that provided part time engineering courses (of which there were several). I rang them all up and talked to the lecturers about my position and what they thought about me taking the course as I

hadn’t taken math’s since GCSE. Bolton University were by far the most helpful and their HNC Civil Engineering course was centered on industry which I thought would suit me personally. I took all the information I had collected and talked to my employers to ask if they were willing to help me; thankfully they did, giving me a day release every week to attend college and pay the tuition fees which I am incredibly grateful for.

As I mentioned previously, being driven to achieve your goal is crucial, having a young family I wanted to provide for became my driving force. However, ironically because I was studying and working in tandem, I was juggling working, studying and a home/social life. This was not sustainable and sacrifices had to be made. I wasn’t able to always go to the park with the kids or go to the pub to watch the football with my mates as I had studying to do. I would be working most nights sometimes until 2 or 3am in the morning then getting up at 6.30am and going to work. I know that sounds like a Monty Python sketch but it is the reality of the amount of work needed. I’d like to be able to tell you how many hours a week you will need to study in order to pass the HNC but in all honesty I couldn’t tell you. What I can tell you is that I did something everyday, whether that was writing an assignment or simply watching a YouTube video on beam analysis.

As long as the driving force behind why you are looking to make this transition is strong enough you’ll make those sacrifices without even noticing you are making them. For me, it is only when I look back do I realise how hard it has been and I’m still training!

The second common misconception is that scaffold design is the construction industries equivalent to the premier league footballer, paid a fortune for easy work. In reality the designs you see as a scaffolder are the end product of many hours hard work both designing and proving through calculation that the designs work. I was once told that this transition is like swapping from the top of a ladder leaning against the wrong house to the bottom of a ladder leaning against the right house. I know this sounds a little silly but it resonated with me as when I left scaffolding to take up a position here at 48.3 Scaffold Design I took a huge pay cut. The truth is I would of probably taken an even bigger pay cut to take the job as I saw it as my first foot on the right ladder! I was competing for this position with young graduates who were fresh out of university and as such the

salary reflects that.

part time engineering courses (of which there were several). I rang them all up and talked to the lecturers about my position and what they thought about me taking the course as I

hadn’t taken math’s since GCSE. Bolton University were by far the most helpful and their HNC Civil Engineering course was centered on industry which I thought would suit me personally. I took all the information I had collected and talked to my employers to ask if they were willing to help me; thankfully they did, giving me a day release every week to attend college and pay the tuition fees which I am incredibly grateful for.

As I mentioned previously, being driven to achieve your goal is crucial, having a young family I wanted to provide for became my driving force. However, ironically because I was studying and working in tandem, I was juggling working, studying and a home/social life. This was not sustainable and sacrifices had to be made. I wasn’t able to always go to the park with the kids or go to the pub to watch the football with my mates as I had studying to do. I would be working most nights sometimes until 2 or 3am in the morning then getting up at 6.30am and going to work. I know that sounds like a Monty Python sketch but it is the reality of the amount of work needed. I’d like to be able to tell you how many hours a week you will need to study in order to pass the HNC but in all honesty I couldn’t tell you. What I can tell you is that I did something everyday, whether that was writing an assignment or simply watching a YouTube video on beam analysis.

As long as the driving force behind why you are looking to make this transition is strong enough you’ll make those sacrifices without even noticing you are making them. For me, it is only when I look back do I realise how hard it has been and I’m still training!

The second common misconception is that scaffold design is the construction industries equivalent to the premier league footballer, paid a fortune for easy work. In reality the designs you see as a scaffolder are the end product of many hours hard work both designing and proving through calculation that the designs work. I was once told that this transition is like swapping from the top of a ladder leaning against the wrong house to the bottom of a ladder leaning against the right house. I know this sounds a little silly but it resonated with me as when I left scaffolding to take up a position here at 48.3 Scaffold Design I took a huge pay cut. The truth is I would of probably taken an even bigger pay cut to take the job as I saw it as my first foot on the right ladder! I was competing for this position with young graduates who were fresh out of university and as such the

salary reflects that.

My in house training at 48.3

Far from my education being over now that I am employed as a Technical Design Draughtsman, here at 48.3 I am being put through a training scheme. This training is integrated into my working day and encompasses not only our design procedures but also the legal and ethical reasons behind how we design scaffolds. This training teamed with being surrounded by some of the most forward thinking engineers in the industry is giving me the knowledge and skills to become a fantastic design engineer. As my training progresses and I generate more revenue for the company so too my personal income will increase.

Since starting work here and undertaking the in house training scheme I have expressed an interest in pursuing my formal education further which was encouraged and supported by everyone here at 48.3. The mentoring I receive from everyone here in the design team is invaluable, the guidance and support is fantastic. I cannot express enough how much benefit it would be for anyone who is thinking about making this transition to find a mentor. Since being mentored here at 48.3 Scaffold Design I have progressed faster than I could of ever imagined.

integrated into my working day and encompasses not only our design procedures but also the legal and ethical reasons behind how we design scaffolds. This training teamed with being surrounded by some of the most forward thinking engineers in the industry is giving me the knowledge and skills to become a fantastic design engineer. As my training progresses and I generate more revenue for the company so too my personal income will increase.

Since starting work here and undertaking the in house training scheme I have expressed an interest in pursuing my formal education further which was encouraged and supported by everyone here at 48.3. The mentoring I receive from everyone here in the design team is invaluable, the guidance and support is fantastic. I cannot express enough how much benefit it would be for anyone who is thinking about making this transition to find a mentor. Since being mentored here at 48.3 Scaffold Design I have progressed faster than I could of ever imagined.

My words of advice

My final advice is this transition will not happen over night and you will probably question why you are doing it but take it from me it is definitely worth it. I suppose if I had to leave you with a guide to becoming a technical design draughtsman for an advanced scaffolder then I would say:- Make sure your drive is strong because it’s going to be very hard.

- Ask yourself WHY do you want to be a design engineer?

- Be aware that sacrifices will need to be made especially if you have a family with young children.

- Finally and most importantly find a mentor whether that be an individual who has successfully made the transition or a company that is willing to guide you with advice or even training.

BREAKING: Three killed in scaffolding collapse in North Carolina, USA

Three workers are dead and one other is in hospital after a section of scaffolding has collapsed at a tall construction project in North Carolina.

Emergency responders say the scaffold peeled away from the glass and steel building and collapsed into a car park in Raleigh. Authorities are working to identify the dead and the cause of the accident. Construction industry accidents are the leading cause of workplace death in North Carolina, officials say. The four workers were all involved in the construction project, Wake County EMS district chief Jeffrey Hammerstein said. Other workers at the scene said the surviving worker, who is reported to be severely injured, was found breathing but almost unresponsive in a portable toilet. It is not clear whether the man fell into the toilet or was inside when the scaffolding fell. The workers were dismantling the scaffolding when the collapse happened around 11:00 local time (15:00 GMT), local television reported. Emergency officials have cordoned off the area around the construction site, and state and federal investigators are said to be on the scene. The 11-story building under construction is set to open in May, local reports say. Nineteen people were killed at construction sites in North Carolina in 2014, according to the state’s labour department.PLETTAC METRIX Open Days

- • Meet and Greet over Tea/Coffee/Pastries etc… • Metrix System overview presentation, unique aspects of the system – by Steve Coshall; • Question and Answers session; • Live practical demonstrations of the Metrix system – by Alan Slater; • Presentation of the use of Metrix from a Contractor’s standpoint – by Mr Des Moore, Group MD; (previously MD of TRAD Scaffolding with over 40 Years Industry experience) • Open Session to discuss specific projects and potential labour/cost savings.

Blencowe Makes History with Temporary Roof Scaffold

Blencowe Scaffolding ‘leads the way’ after installing the first ever Layher Keder XL roof system on a UK construction project.

Months of precision planing and a highly skilled team of scaffolders from Blencowe Scaffolding Ltd made history yesterday after successfully installing a 27 tonne temporary roof to the world famous Winchester Cathedral. Hundreds of spectators from around Winchester witnessed the 300 tonne crane, which is one of the biggest mobile cranes in Britain lift seven prebuilt sections of the Layher Keder XL roof system into place. The ambitious structure will stay in place providing weather protection for the next two years. The temporary roof is believed to be the biggest single scaffolding structure ever to be put on a British Cathedral.

The 11th Century Winchester Cathedral is currently undergoing a £20.5m restoration works program with £4m being spent on major roof repairs. The temporary roof will allow 40 roofers to remove the existing lead, which is broken and leaking. The lead will then be melted down off-site and recast to last another 150 years.

Speaking to ScaffMag Alan Blencowe, of Blencowe Scaffolding said;

“It was a tremendous project to be involved with and it’s been great working closely with Winchester Cathedral’s project management team and Layher UK. We’d like to say a huge thank you to all our scaffolders that were involved in the project and for helping to make it such a success.”

“We hope to undertake more projects of this magnitude in the near future and pleased to announce that we now have a separate division within Blencowe Scaffolding Ltd for Layher scaffolding projects.”

Site Construction Manager Ian Bartlett said;

“As far as we know, this is the first time that this has taken place on a Cathedral in this country. Apart from the complexities of building the framework in the first place, the logistics of working in a relatively tight space at that end of the building to achieve the lift mean that everything has to be planned to the minutest degree.”

The temporary roof is believed to be the biggest single scaffolding structure ever to be put on a British Cathedral.

The 11th Century Winchester Cathedral is currently undergoing a £20.5m restoration works program with £4m being spent on major roof repairs. The temporary roof will allow 40 roofers to remove the existing lead, which is broken and leaking. The lead will then be melted down off-site and recast to last another 150 years.

Speaking to ScaffMag Alan Blencowe, of Blencowe Scaffolding said;

“It was a tremendous project to be involved with and it’s been great working closely with Winchester Cathedral’s project management team and Layher UK. We’d like to say a huge thank you to all our scaffolders that were involved in the project and for helping to make it such a success.”

“We hope to undertake more projects of this magnitude in the near future and pleased to announce that we now have a separate division within Blencowe Scaffolding Ltd for Layher scaffolding projects.”

Site Construction Manager Ian Bartlett said;

“As far as we know, this is the first time that this has taken place on a Cathedral in this country. Apart from the complexities of building the framework in the first place, the logistics of working in a relatively tight space at that end of the building to achieve the lift mean that everything has to be planned to the minutest degree.”

Chris Sedgeman Wins Access & Scaffolding Specialist of the Year 2015

Cornish scaffold contractors Chris Sedgeman Scaffolding scoop the prestigious Construction News Access & Scaffolding Specialist Award.

At a star studded event at the Hilton in London yesterday (18 March) Chris Sedgeman Scaffolding Ltd for the 2nd year on the trot was awarded the accolade after fierce competition from the other finalists.

The judges said Sedgeman ticked all the boxes when making their decision on the winner after the firms performance on a challenging emergency project on the Cornish coastline in 2014.

In a incredibly short space of time over 35 tons of scaffolding were supplied and installed before the next storm hit the Cornish coastline. The firm developed innovative ideas for most of the scaffolds on site and played a crucial role in a very high-profile emergency project.

speaking after the event Chris Sedgeman, Managing Director told ScaffMag:

“We are delighted with winning the Access and Scaffolding Award and feel proud of how much we have accomplished throughout the year. To receive this award gives us the incentive to progress the company further in more specialist areas and expand into different parts of the country.”

“We would like to say well done to all the other finalists for their great work and thank them for there kind messages. We would also like to thank all our employees, suppliers and clients for their support during the past year, and look forward to working with them in the future.”

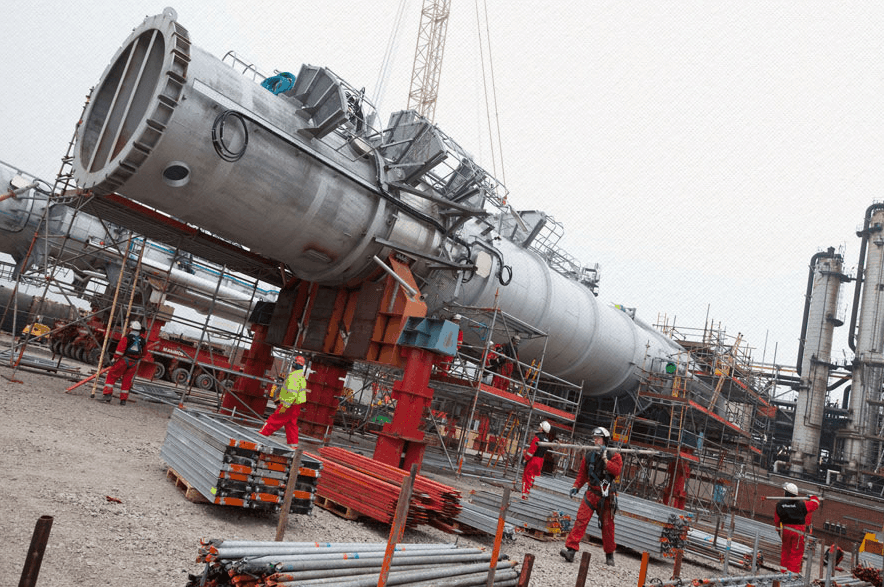

Altrad Acquires Hertel For A £164M Deal

Altrad has entered into an agreement to acquire Hertel’s access, insulation, corrosion protection and mechanical businesses.

French mega company, Altrad is about to add yet another industry firm to it’s bursting business portfolio. Altrad and Hertel’s shareholders have reached an agreement for the acquisition of Hertel’s worldwide access solutions, insulation, corrosion protection and mechanical businesses. However, Hertel’s offshore business, which designs, constructs and delivers living quarters and accommodation modules, will not be included in the transaction. The merger of Altrad and Hertel will have a joint annual turnover in excess of € 1.6 billion and employ approximately 17,000 people worldwide. Hertel will continue to operate under its current leadership and the Hertel brand. Previous UK acquisitions by Altrad include Trad, BarOmix, Belle Group, Beaver 84, NSG, Generation and MTD. A statement on Hertel’s website reads: Altrad and the shareholders of Hertel have reached an agreement with respect to the acquisition by Altrad of Hertel’s worldwide access solutions, insulation, corrosion protection and mechanical businesses. This agreement has the full support of Hertel’s management, and is subject to the customary approval of competition authorities as well as completion of the consultation process with Hertel’s works council. The transaction is expected to close in the second quarter of 2015. The combination of Altrad and Hertel, which will have a joint annual turnover in excess of € 1.6 billion and employing approximately 17,000 people, will result in a leading company in its businesses in Europe, the Middle East, Caspian and Asia Pacific. Hertel Offshore, which designs, constructs and delivers living quarters and accommodation modules, will not be included in the transaction. Hertel Offshore will be continued under the ownership of NPM Capital and Sofinim (the development capital affiliate of Ackermans & van Haaren). Hertel’s senior management will stay involved with the Offshore operations. The Offshore business had a turnover of € 60 million in 2014. The business will change its name going forward.Altrad to acquire Hertel to create a leading company in multi-disciplinary technical services. Our press release:http://t.co/PeHnrAW2Bh

— Hertel (@hertel_global) March 17, 2015

Hertel announces the news on twitter

Altrad Group president Mohed Altrad said:

“We consider Hertel a promising and exciting company with an attractive long-term growth potential, solid management and corporate values very similar to Altrad. Combining management teams with different sets of experience will enable us to actively exchange ideas and best practices thereby making the combination a benchmark in its industries.”

Victor Aquina, CEO of Hertel said:

“We are excited about this new step in the rich history of Hertel, With dedication, we have been able to successfully finalise the turnaround of Hertel and developed a strong foundation, together with our shareholders, for a bright future for our company. Altrad will be an excellent partner enabling Hertel to realise its ambitions in accordance with our long term growth strategy. I am convinced that this transaction is in the best interest of Hertel , for our customers, our employees and our shareholders.”